Credit Cards After Bankruptcy - Self- Self Credit Builder

How How long after a bankruptcy will my credit score - WalletHub can Save You Time, Stress, and Money.

Technically, you can start obtaining credit cards as quickly as your insolvency is released. That generally takes around 3 months from the filing date for Chapter 7 personal bankruptcies. Chapter 13 bankruptcies take longer due to the fact that they involve repayment strategies that can take anywhere from 3 to five years to complete.

Free Credit Score - Credit Sesame

"The large majority of the offers are terrible deals with predatory rate of interest," Slayton says. "I counsel my customers to throw them in the garbage." If you're not getting pre-approved offers or getting refused from a charge card company after personal bankruptcy, examine your credit report. Don Petersen, a customer attorney with the Law Workplace of Donald E.

It is most likely that a credit card business will examine your credit rating prior to approving you. Petersen says: "If you received a discharge under a Chapter 13 payment strategy, you're typically able to restore credit soon after receiving your discharge." "If you declared guaranteed financial obligations such as a car loan or mortgage, you can restore your credit much quicker than someone who did not declare such debts," Petersen says.

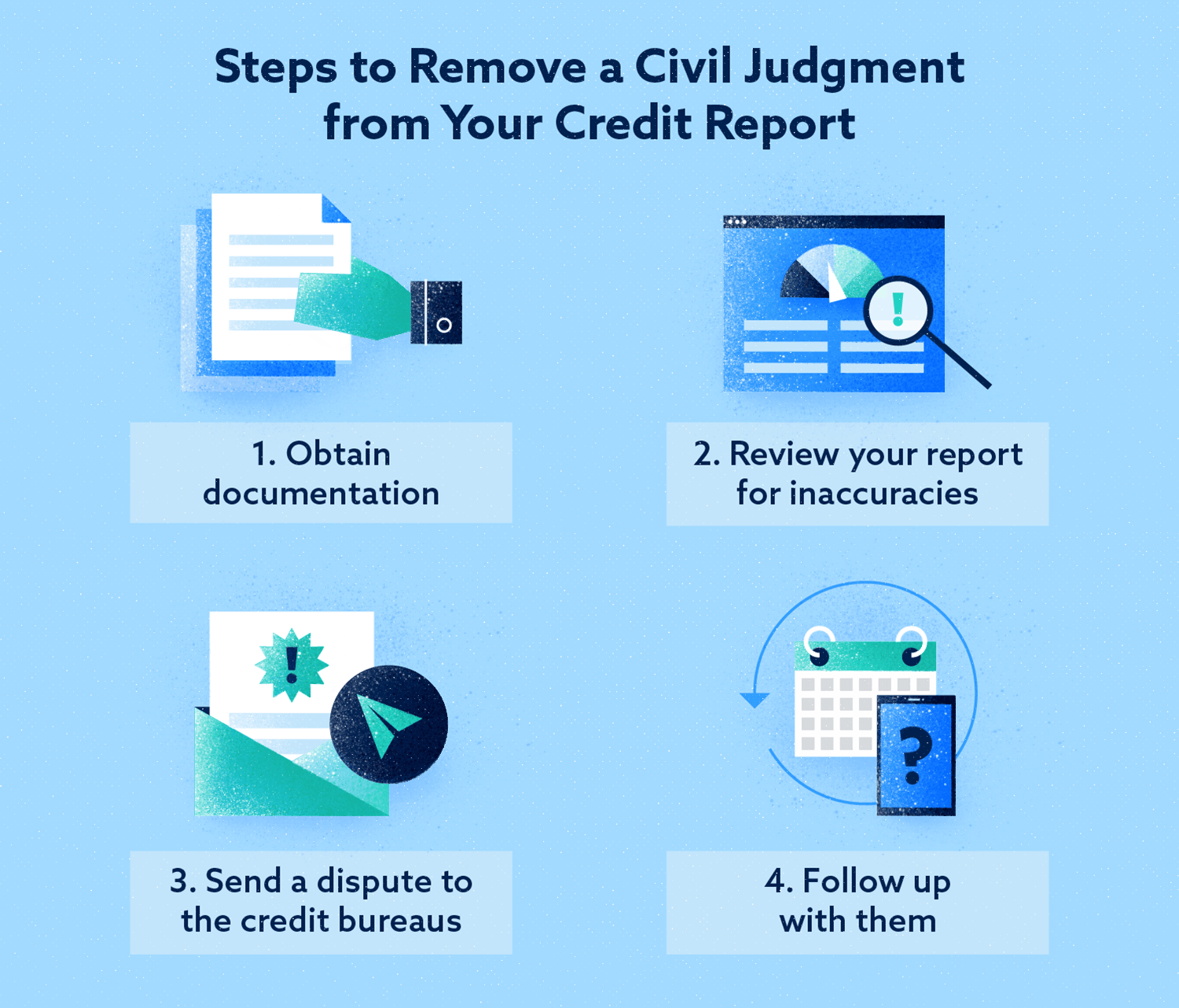

But that doesn't constantly take place. "Numerous creditors sell discharged financial obligations and continue to leave balances, including charge off amounts and unpaid balances, on a consumer's credit report," Petersen says. Another Point of View to be safe Around 60 to 90 days after getting your Order of Personal bankruptcy Discharge confirming you are no longer accountable for repaying the debts that were discharged in your personal bankruptcy case, order a copy of your credit report from Review the reports to ensure that the balance on all released debts is absolutely no.

Free Credit Score - Credit Sesame

How How to Rebuild Credit After Bankruptcy--5 Easy Steps can Save You Time, Stress, and Money.

The FTC has a sample letter for disputing mistakes on your credit report that can assist. You might wish to send out a copy of the disagreement letter to the financial institution who is reporting incorrect information as well as the credit reporting firm. The credit reporting firm then has thirty days to investigate the items in concern.

7 Tips to Improve Your Credit Score After Bankruptcy

They'll also send you a totally free copy of your credit report if the dispute results in a modification to your file. Even if you inspected your credit report a couple months after bankruptcy, Petersen recommends continuing to monitor it. Incorrect details can come back in some cases even years after the insolvency court discharged the debt.